In this article, I will discuss the Best Mobile Banking Apps For Budgeting. These applications enable one to manage their money better, monitor their financial transactions, and achieve their financial goals without any lapse.

If you enjoy visuals, working with other people, or prefer savings done for you, smarter, stress-free budgeting awaits you with the right app.

Key Point & Best Mobile Banking Apps For Budgeting List

| App Name | Key Point |

|---|---|

| Simplifi by Quicken | Provides real-time spending tracking and goal-based planning with clean UI. |

| YNAB (You Need A Budget) | Focuses on zero-based budgeting to give every dollar a job. |

| PocketGuard | Automatically identifies recurring bills and shows how much you can spend. |

| Monarch Money | Offers collaborative budgeting for couples with customizable categories. |

| Goodbudget | Envelope budgeting system ideal for shared family budgeting. |

| Spendee | Visual budget tracking with shared wallets and multi-currency support. |

| Empower Personal Dashboard | Combines budgeting with investment and retirement tracking tools. |

| CountAbout | Syncs with bank accounts and allows import from Quicken or Mint. |

| Rocket Money | Tracks subscriptions and negotiates bills to help lower expenses. |

1.Simplifi by Quicken

Simplifi by Quicken is one of the best mobile banking apps for budgeting because of its effective user interface and instant access to finances.

Unlike traditional budgeting tools, it provides customized spending plans that adapt to your habits so you can stay within your budget without putting in too much effort.

It is user friendly due to its automated transaction categorization, bill monitoring, and flexible savings goal setting. Simplifi enables effortless financial control which reduces stress and transforms budgeting into a proactive activity.

Simplifi by Quicken Pros & Cons

Pros:

Cons:

2.YNAB (You Need A Budget)

YNAB (You Need A Budget) is one of the best mobile banking apps for budgeting because it fundamentally changes the way users handle their finances, creating a transformational experience.

As one of its characteristics, every dollar received is budgeted expenditure as income creates purpose with spending through the zero-based budgeting approach.

What differentiate YNAB from the rest is how it aids users to change for the better—building money management skills over time. Financial control, whereby all the systems encourage forward-looking expenditure budgeting comes within reach without one enduring financial tension.

YNAB (You Need A Budget) Pros & Cons

Pros:

Cons:

3.PocketGuard

PocketGuard automagically qualifies to be one of the best mobile banking apps for budgeting since it offers ease of understanding one’s finances.

Its strongest feature is the “In My Pocket” tool, which tells users exactly how much can be spent safely after paying for bills, savings, and personal goals. This “spending allowance” helps people manage to avoid overspending without the need for manual effort.

PocketGuard makes money management easier by syncing transactions without the user’s input and categorizing them with intelligent algorithms which provides users a realistic and actionable information regarding their finances.

PocketGuard Pros & Cons

Pros:

Cons:

4.Monarch Money

Monarch Money is among the best mobile banking apps for budgeting, given its emphasis on collaborative financial planning. Its distinct advantage is enabling couples and families to manage shared budgets, goals, and investments from one platform.

Users can observe spending, plan for the future, and create categories that suit their lifestyle. Monarch helps users make joint decisions with ease through comprehensive cash flow projections, making budgeting as a team organized, clear, and controlled.

Monarch Money Pros & Cons

Pros:

Cons:

5.Goodbudget

Goodbudget gets flashes of its name as one of the best mobile banking applications for budgeting as it automates the envelope system.

A user-centered Goodbudget design engages spending in a proactive rather than reactive approach. With virtual envelopes set aside for various purposes, users spend purposefully rather than mindlessly.

Also, it has multi-device sync support which is perfect for couples or families who want to budget together with unified visibility and shared goals.

Goodbudget Pros & Cons

Pros:

Cons:

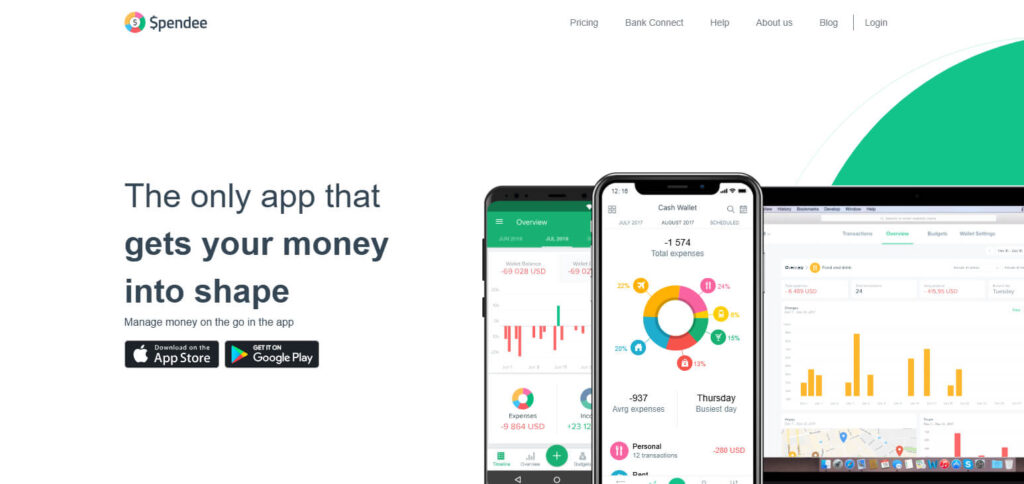

6.Spendee

Spendee is said to be one of the best mobile banking apps for budgeting because of its impressive user interface and management of shared finances. Spendee’s distinct feature is its ability to create shared wallets, which allows people to budget together with other users, family, or partners.

Furthermore, it is perfect for international users since it is capable of multilateral currency handling. Through beautiful charts and real time synchronization, Spendee makes managing finances not only visually beautiful, but also productive catered to different ways of living.

Spendee Pros & Cons

Pros:

Cons:

7.Empower Personal Dashboard

Empower Personal Dashboard is among the best mobile banking applications for managing budgets as it integrates everyday planning with advanced wealth management.

It uniquely combines spending and investment tracking. Users can manage cash flow, set retirement benchmarks, and monitor net worth over time. Empower’s all-encompassing view does not only enable users to manage monthly expenses, but also enables smarter decision-making towards financial goals.

Empower Personal Dashboard Pros & Cons

Pros:

Cons:

8.CountAbout

CountAbout is among the best mobile banking apps for budgeting because of its effortless syncing with older systems such as Quicken and Mint.

Its primary forte lies in providing a completely customizable experience e.g., users can design unique categories, tags, and reports that align with their financial behavior.

CountAbout also allows automatic downloading of transactions from financial institutions to keep data current. Advertisements free and an uncluttered interface makes it optimal for individuals who appreciate unrestrained access to personal data.

CountAbout Pros & Cons

Pros:

Cons:

9.Rocket Money

Rocket Money is one of the best mobile banking apps for budgeting as it aids users in discovering and minimizing disguised expenses.

Rocket Money’s standout feature is subscriptions auto-detection and cancellation, letting users govern recurring payments they may have neglected.

The application also monitors user spending, provides goal-setting tools, and helps users drop their bills. Unlike other applications, Rocket Money emphasizes saving and acts as a non-intrusive lifestyle financial assistant.

Rocket Money Pros & Cons

Pros:

Cons:

Conclusion

To summarize, the ultimate mobile banking applications for budgeting do not merely allow users to track their expenses;

rather, they provide sophisticated tools aimed at assisting individuals at different life stages to reclaim financial authority like envelope budgeting, spending caps, joint planning, and even subscription cancellation/renewal services.

Touted as having the most sophisticated technological automation, any modern budgeting app actively facilitates smarter, faster, and effortless personal financial management at any time of the user’s choosing.